I really wanna get my credit up so I can get the best rates when I ever I wanna take out loans in the near future. I f***ed it up last year because I was out of work for 1-2 months because I had a work related injury then ended up quitting my job. With no sort of income, I had been late on payments for several months. Any tips and tricks, KTT financial gurus?

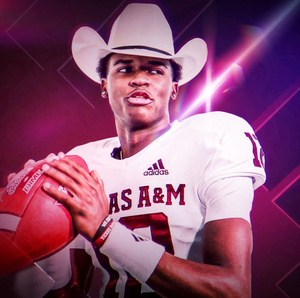

@op I don't know anything about credit but maybe this video will help.

Snippet from this 1 hour video

Tubig 🌊Jul 22, 2020

Tubig 🌊Jul 22, 2020There's 2 dates you need to know with regards to credit cards. Due date, which i'm sure you know. And the reporting date. The reporting date is when the card company reports to the credit bureaus. To optimize your credit score, it's best to have 10% credit utilization on the reporting date. Then make sure you pay the balance on the due date to avoid paying interest.

I usually use my credit card on payments that I’m bound to make. Like my cell phone bill or insurance. That way I’m not using it recklessly and not panicking when the payment is due. It’s a set amount that is manageable and hardly changes. I usually pay on the due date or the day prior. My scores been in the 700s for as long as I remember.

Your mom smart af but she should let you know the procedure cause yo ass f***ed up all that hard work