Birdie

BirdieI was there for 1.5 years, was hit with the great resignation and my entire team quit so I got some senior role responsibilities for a few months.

Try to be kind/polite, responsible, and a good listener to your seniors or co associates

Don’t overthink social interactions or feel pressured to act a certain way outside of just being a professional

Lot of the NYC office is made up Asian internationals who have a good understanding of English but strong accent/not too much American socialization

Man I have a terrible habit of overthinking/overanalyzing social interactions, even the smallest slip-up remains in my thoughts lol. You have a great point about listening more than talking especially with the higher-ups though, need to practice it more.

Your NYC office sounds like the perfect environment, being around extroverts or people who engage in office banter is more exhausting than the work itself, at least for me.

Dealers In Paris

Dealers In ParisMan I have a terrible habit of overthinking/overanalyzing social interactions, even the smallest slip-up remains in my thoughts lol. You have a great point about listening more than talking especially with the higher-ups though, need to practice it more.

Your NYC office sounds like the perfect environment, being around extroverts or people who engage in office banter is more exhausting than the work itself, at least for me.

Oh no man NYC office is filled with the extroverts/drinkers/frats still

Thing is the offices there are so big many teams have different subcultures

You’ll have teams filled with quiet internationals, others with basic frat/sorority kids, and others with super type a people

Getting a good team that fits well with your personality is luck but you have a resource manager to ask for switches

People at big 4 are pretty basic — all they talked about were sports, love island, and whatever restaurants or bar is popular

Birdie

BirdieOh no man NYC office is filled with the extroverts/drinkers/frats still

Thing is the offices there are so big many teams have different subcultures

You’ll have teams filled with quiet internationals, others with basic frat/sorority kids, and others with super type a people

Getting a good team that fits well with your personality is luck but you have a resource manager to ask for switches

People at big 4 are pretty basic — all they talked about were sports, love island, and whatever restaurants or bar is popular

Heard the auditing field in general attracts douchier people, compared to Tax. With that said I can view it as an opportunity to further develop my social skills, not only interacting with coworkers but clients too.

My brother pointed out how my speech always gives the impression that I’m stupid or incompetent, despite the work I produce showing otherwise. Already getting nervous at the thought of departing from my current role and having to apply for jobs again, since I can’t help but feel employers always judging me.

Still appreciate your advice though

ASAKI

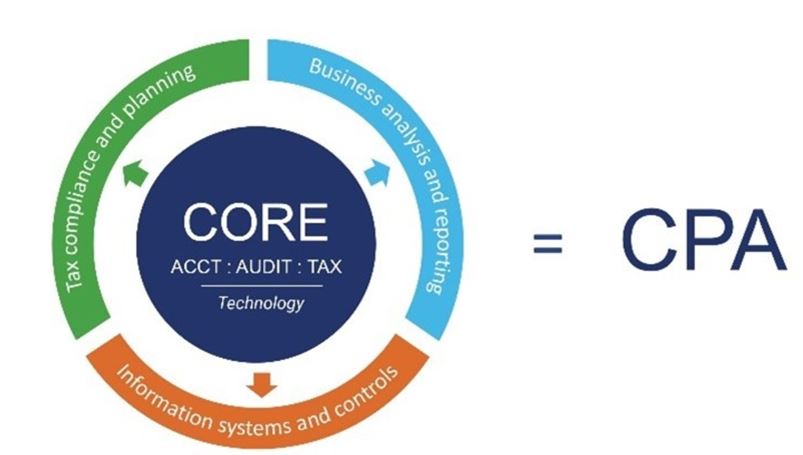

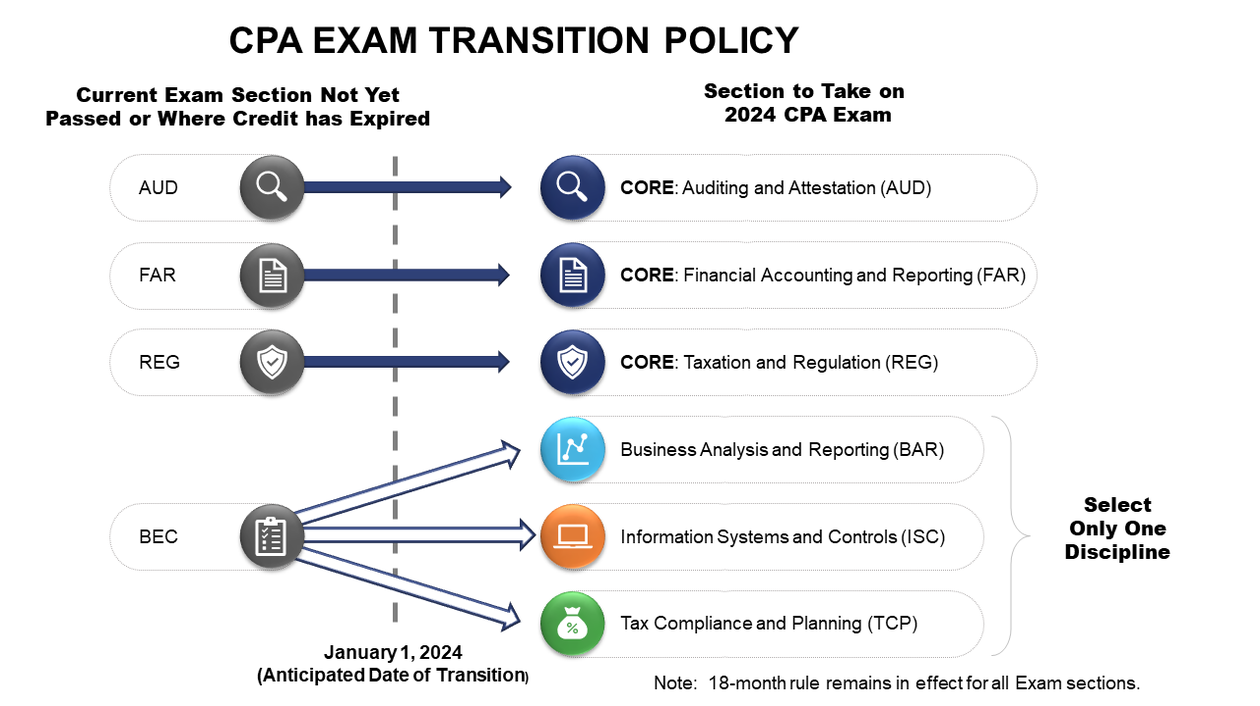

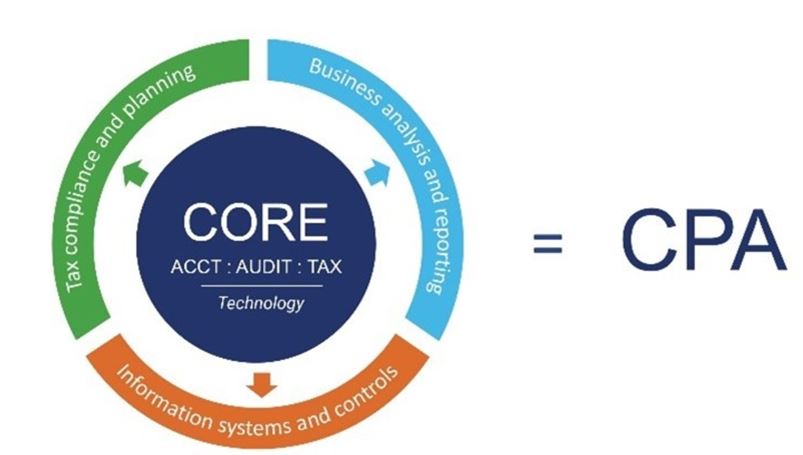

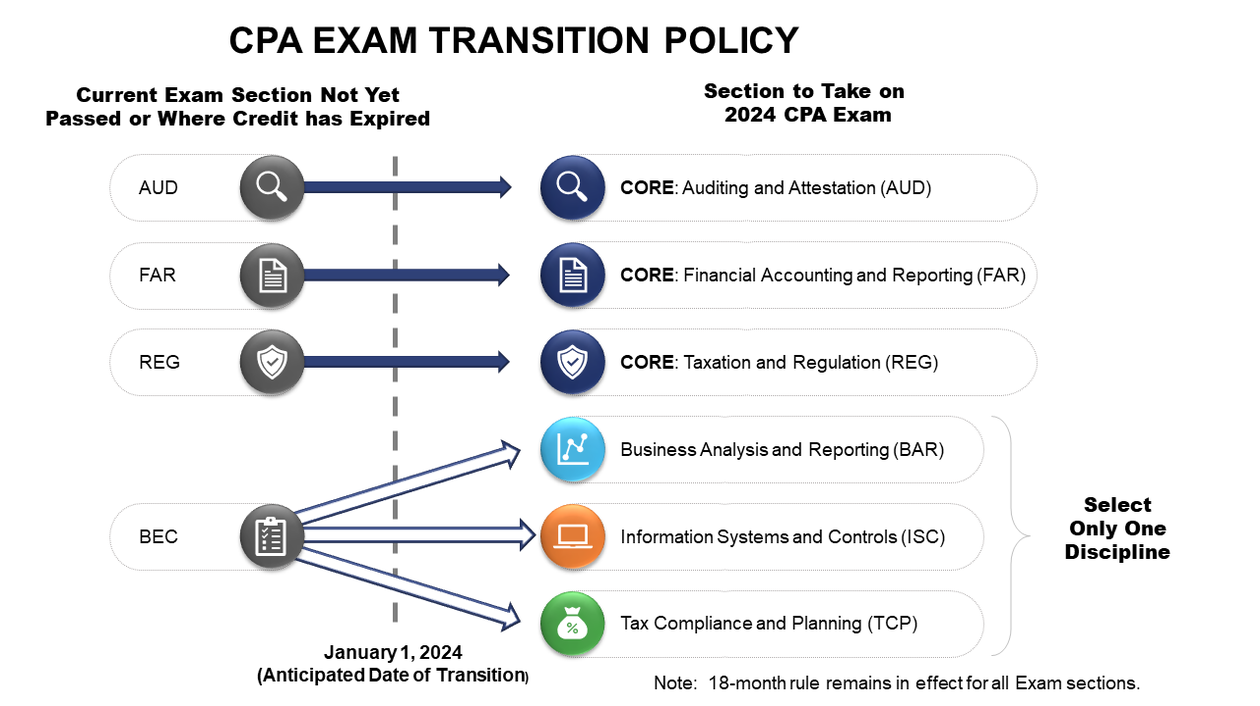

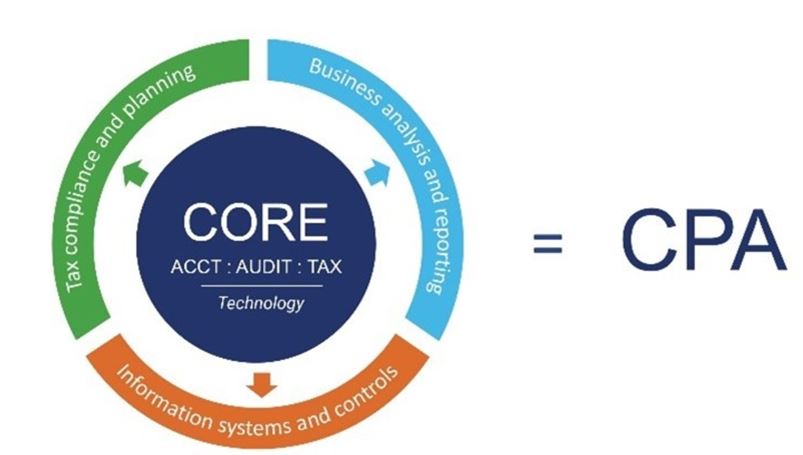

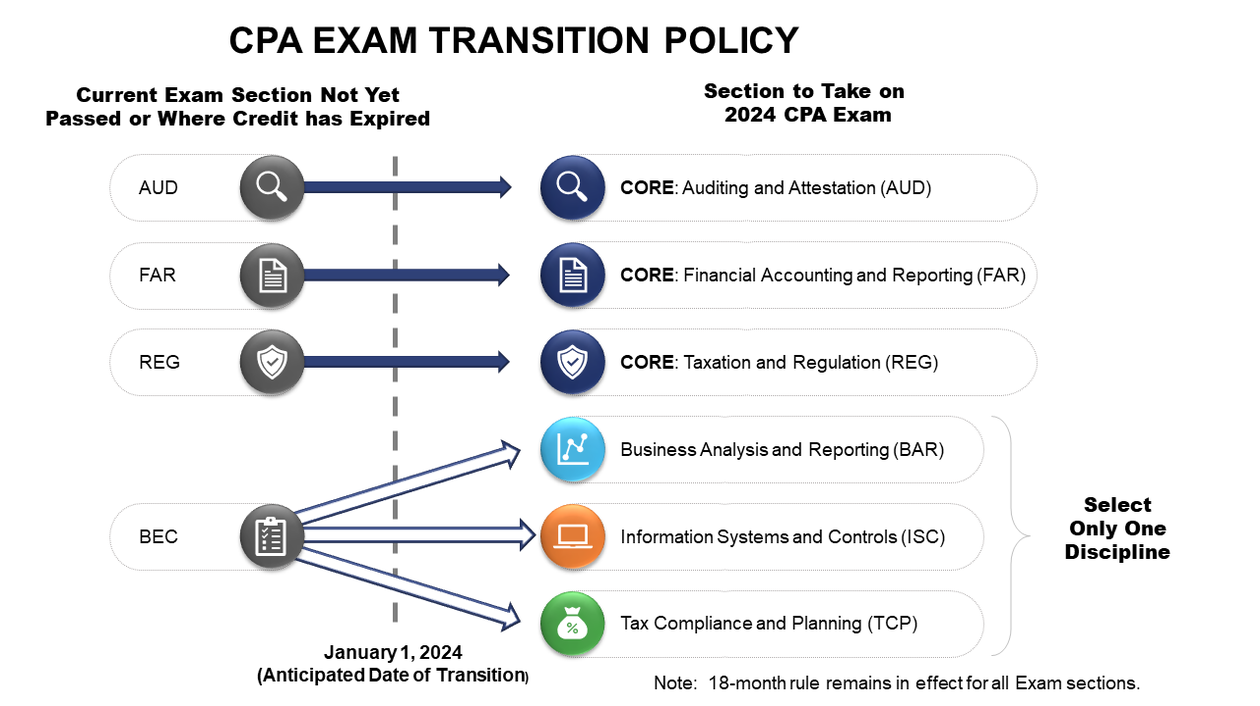

ASAKIMy goal is to get all of them done before the new ones roll out but the strategy I kinda decided on was

FAR --> AUD --> BEC --> REG

My thinking is that FAR will be the hardest obviously, but AUD and BEC use a lot of topics from FAR, so it'll be fresh in my mind.

I'm a little scared of taking REG last though because I'm an auditor and not involved in taxes in any way lol. But funnily enough I did better in my Tax classes than Audit so go figure

bec is being completely removed though and replaced with more specialized versions of the other 3. So just a warning

Birdie

Birdie100% but I’m probably switching jobs again and will be back to 60 year round if I end up in sell side research at a bank

What's your endgame

I think I want to eventually get into CorpDev and stick it out there, just need a good path from IA.

I think I want to eventually get into CorpDev and stick it out there, just need a good path from IA.Thinking the plan will be IA --> FP&A --> (Maybe Treasury here) --> CorpDev, all internal transfers.

Dedication 666

Dedication 666bec is being completely removed though and replaced with more specialized versions of the other 3. So just a warning

Yep, that's why it's not necessarily last in my order, just in case I do fail a part earlier on. I still have the year to take all of it.

And, push comes to shove, I would much rather deal with the new BEC than whatever they hell they might cook up with revised FAR

i'm a CPA in Canada and have been working for a long time (relative I guess to the age of people on this site) and I wanted to share some insights I have:

the CPA does make a difference. It increases you earnings, job prospects and upward potential in a company. When you compare it to the cost of getting an MBA I think it's pretty cost effective (assuming you went to a university with the pre-req courses)

Accounting is boring as f*** in a lot of cases. You are going to be doing repetitive work for boomer companies a lot of the time.

Tax is more interesting but way harder. You also get boxed into a specific type of role. You also make a lot more than auditers/corporate accountants bc the pool of talent is very low

Industry is probably the right option for most people. 9 to 5 with occasional overtime at month /quarter/year ends. You can work at a cooler company but again but you won't really be attached to the client side of things.

Most people who have a good personality end up working in FP&A (financial planning & a***ysis). Eventually this can take you to a more sales/operations/strategy role

Big 4 is terrible. You work like a dog, make no money and it is a very bad work environment. You will meet cool people and learn a lot about yourself but it's not good. Anyone who flexs about how many hours they work is a loser. Spend that time with your loved ones not tying A/R accounts.

Benefits of B4 is that your promotions are scheduled providing you aren't terrible, you have exit options and you are a very well rounded accountant a lot of times. You learn the most at small firms because youre jack of all trades but B4 can be good to specailize

The exit at b4 is often times glamourized and is really regional/client dependent. A lot of ppl I know in Toronto end up exiting doing corp accounting manager jobs for mining or other factory companies. Not exactly sexy but no shade work is work

Finally the CPA at least here in my view has been devalued. You have a lot more applicants and the pathway is a lot more lenient to register as a CPA student, you don't even need an accounting degree. This has become a $$$ scheme so you take the CPA accounting modules and what not. Also at least here you can do your CPA all through industry and somehow being a designated individual and not knowing how to do a tax return to me is shocking. That might be a bit boomer of me tho.

Overall not for everyone and requires a lot of dedication and willingness to learn. You have to enjoy it, do not pursue accounting just to make money you will hate your life. Work hard, don't make careless mistakes and show initiative to learn. You will do great!

lnstinct

lnstinctWhen brother 0 free?

No idea, heard he not returning from someone, but hope not.

Free bonfire

If there's a freelance accountant here in Atlanta, I have a potential job for you, working with a real estate company here in the city. Let me know, please.

ASAKI

ASAKIYep, that's why it's not necessarily last in my order, just in case I do fail a part earlier on. I still have the year to take all of it.

And, push comes to shove, I would much rather deal with the new BEC than whatever they hell they might cook up with revised FAR

bec wont be a thing anymore. instead you will pick between one of the more specialized exams.

FredVanYeet

FredVanYeeti'm a CPA in Canada and have been working for a long time (relative I guess to the age of people on this site) and I wanted to share some insights I have:

the CPA does make a difference. It increases you earnings, job prospects and upward potential in a company. When you compare it to the cost of getting an MBA I think it's pretty cost effective (assuming you went to a university with the pre-req courses)

Accounting is boring as f*** in a lot of cases. You are going to be doing repetitive work for boomer companies a lot of the time.

Tax is more interesting but way harder. You also get boxed into a specific type of role. You also make a lot more than auditers/corporate accountants bc the pool of talent is very low

Industry is probably the right option for most people. 9 to 5 with occasional overtime at month /quarter/year ends. You can work at a cooler company but again but you won't really be attached to the client side of things.

Most people who have a good personality end up working in FP&A (financial planning & a***ysis). Eventually this can take you to a more sales/operations/strategy role

Big 4 is terrible. You work like a dog, make no money and it is a very bad work environment. You will meet cool people and learn a lot about yourself but it's not good. Anyone who flexs about how many hours they work is a loser. Spend that time with your loved ones not tying A/R accounts.

Benefits of B4 is that your promotions are scheduled providing you aren't terrible, you have exit options and you are a very well rounded accountant a lot of times. You learn the most at small firms because youre jack of all trades but B4 can be good to specailize

The exit at b4 is often times glamourized and is really regional/client dependent. A lot of ppl I know in Toronto end up exiting doing corp accounting manager jobs for mining or other factory companies. Not exactly sexy but no shade work is work

Finally the CPA at least here in my view has been devalued. You have a lot more applicants and the pathway is a lot more lenient to register as a CPA student, you don't even need an accounting degree. This has become a $$$ scheme so you take the CPA accounting modules and what not. Also at least here you can do your CPA all through industry and somehow being a designated individual and not knowing how to do a tax return to me is shocking. That might be a bit boomer of me tho.

Overall not for everyone and requires a lot of dedication and willingness to learn. You have to enjoy it, do not pursue accounting just to make money you will hate your life. Work hard, don't make careless mistakes and show initiative to learn. You will do great!

yea i hear pay in canada is so much worse 😭

Industry can pay more starting out sometimes but public accounting can pay way more long term. Or stay in public accounting but switch to advisory/consulting. Main benefit of industry is reasonable hours

www quakerboy us

www quakerboy usi have an accounting degree that i’m NEVER gonna use hahaha

why?

Dedication 666

Dedication 666bec wont be a thing anymore. instead you will pick between one of the more specialized exams.

All those years procrastinating finally paid off

Dedication 666

Dedication 666bec wont be a thing anymore. instead you will pick between one of the more specialized exams.

I'm aware, I meant BEC as a catch-all

ASAKI

ASAKIWhat's your endgame

I think I want to eventually get into CorpDev and stick it out there, just need a good path from IA.

I think I want to eventually get into CorpDev and stick it out there, just need a good path from IA.Thinking the plan will be IA --> FP&A --> (Maybe Treasury here) --> CorpDev, all internal transfers.

Honestly not that solid onto anything

I wanted a product a***yst role at a alt data research firm but they pulled back hiring during the process cause of tech stocks crashing

I focus on consumer sector companies right now so either I go to sell side research within the same space and keep building industry expertise or I find another opportunity in fintech

I’d also consider consulting opportunities within the consumer space if those firms start hiring again

I thought about an MBA after 3-4 more years of working ideally on the sell side or in data product role still in finance. I’d want to shoot for a consumer sector consulting role at MBB post-MBA. From there I’d be like 30 and would either stick to consulting life or try to move into an executive role at a retail/food/apparel company.

Birdie

BirdieHonestly not that solid onto anything

I wanted a product a***yst role at a alt data research firm but they pulled back hiring during the process cause of tech stocks crashing

I focus on consumer sector companies right now so either I go to sell side research within the same space and keep building industry expertise or I find another opportunity in fintech

I’d also consider consulting opportunities within the consumer space if those firms start hiring again

I thought about an MBA after 3-4 more years of working ideally on the sell side or in data product role still in finance. I’d want to shoot for a consumer sector consulting role at MBB post-MBA. From there I’d be like 30 and would either stick to consulting life or try to move into an executive role at a retail/food/apparel company.

Consulting is a great opportunity, you can’t go wrong with it depending on what type of advisory or strategy you’re specializing in. Have you considered going into IB if you decide to get an MBA? Could be a lucrative path into PE and VC but it’s a s***ton of hours